[Special Economy=Eunji Kim]With the implementation of the negative interest rate policy, it's becoming more common to deposit money and having to pay a storage fee instead of receiving an interest rate.

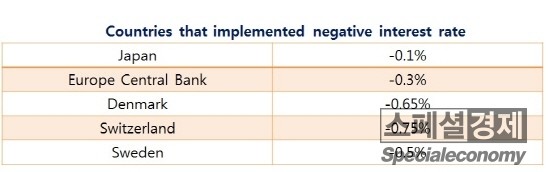

The negative interest rate started in Denmark during 2012, and currently a total of five countries are applying this policy with most of them stationed in Europe.

These countries make up one-fourth of the total world GDP. On top of that, there is a prediction that Canada, Norway, Israel, England and Czech Republic will also implement a negative interest rate sometime.

Looking at Sweden's central bank, it decreased its interest rate the amount of 0.15% to -0.5% on last Thursday. Europe Central Bank, too, implemented a negative interest rate in June 2014 and decreased that from last December's -0.2% to -0.3%.

Japan has followed this policy starting last month on the 29th and already there is a saying that it could decrease to as far as -1%.

“Considering the interest rate, it can continue to decrease further,” said Haruhiko Kuroda, governor of Bank of Japan. “To achieve the goal of increased prices, we are willing to do anything.”

What Kuroda means is that it can be difficult to first apply a negative interest rate, but rather easy to decline it additionally.

Furthermore, according to Sweden's central bank report about “how much further it can reduce the interest rate,” the recent experience states that “the lower limit is not 0%.”

This means that the bottom of a negative interest rate is possible as long as it doesn't exceed the cash placed in the safe by consumers or institutions.

JP Morgan Chase reported that based on the situation with the central bank and the financial market, the Eurozone can shrink its interest rate to -4.5%, Japan to -3.5% and America to -1.3%.

스웨덴 중앙은행도 최근 ‘얼마나 더 기준금리를 깎을 수 있나’는 보고서에서 “최근 경험은 현금 보유 비용 때문에 0%가 하한선이 아님을 보여준다”고 설명했다.

마이너스 금리의 바닥은 사람들이나 기업이 현금을 금고에 쟁여 놓는 비용만 넘기지 않으면 가능하다는 것이다.

우에다 가즈오 도쿄대학 교수는 얼마 전 니혼게이자이신문을 통해 “(유럽의)최근 경험은 소액 은행예금의 금리를 제로 부근에 그대로 둔 채, 마이너스 1% 전후까지 중앙은행 예금의 금리 인하가 가능하다고 시사하고 있다”고 전했다.

JP모건체이스에 따르면 중앙은행과 금융시장 사정에 따라 유로존은 -4.5%, 일본은 -3.5%, 미국은 -1.3%까지 일부 정책금리를 하락시킬 수 있다는 내용이 담겨진 보고서를 발표했다.