A tentative deal was said to be reached on oil production freeze, but questions remain whether this is actually true

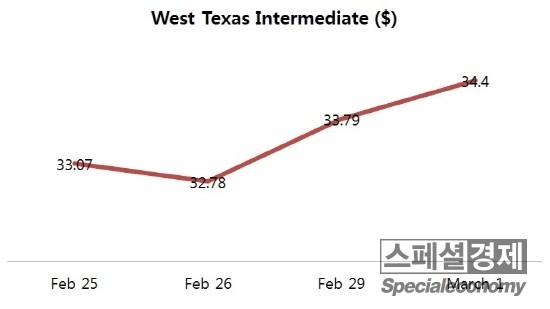

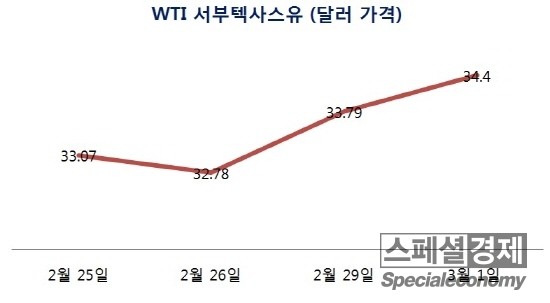

[Special Economy=Eunji Kim]The jitters in the world oil market continues; West Texas Intermediate jumped 2% on Tuesday, recording at the highest number in eight weeks.

On this day, WTI bounced 65¢ (1.9%) and finished at $34.40. In the middle of the trade, it fell as low as $33.37 but with the gains in the New York stock market, this price again increased.

On the other hand, Brent crude’s futures price for this coming May rose 24¢ (0.6%) and traded at $36.81.

The reason for the jump in world oil prices comes from what Russia’s Energy Minister, Alexander Novak, has said.

According to Novak, the 15 oil-producing countries, which take up 75% of the global oil production, have agreed on a freeze in a tentative deal.

Furthermore, the 2% rise in New York stock market also played part in this bounce in oil prices.

Russian state news agency, TASS, reported of Novak’s words that when these 15 countries agree on a freeze, the capping of oil production would prove to be effective even without Iran’s help.

President of that country, Vladimir Putin, added that in addition to this said agreement, there should be a dramatic measure to balance out the oil market.

Accordingly, the statements from energy officials at OPEC, IEA and Russia should be carefully noted.

Last month, on February 22nd, Secretary-General of OPEC, Abdalla Salem El-Badri, said to find a solution for oil oversupply, his organization will cooperate with non-cartel countries.

But, the truth behind El-Badri’s words is questionable: what he said can be for the mere purpose of a oil price recovery.

Last January, Novak’s announcement that Saudi will cut its oil production proved to be a lie, leading to plunging oil prices.

With all that, a suspicion rises of Novak’s most recent comment; Will an agreement happen for real? Or is it just another fat lie?

닐 애트킨슨 IEA 국제석유시장 부문장의 발언도 호재 영향을 불어 일으켰다. 애트킨슨 IEA 부문장은 “내년 원유시장이 균형을 되찾으리라는 기대를 반영해 유가가 올해 내내 오를 것이며, 상승세가 내년으로 이어질 것으로 보인다”고 내다봤다.

최근 OPEC과 IEA, 러시아 등 석유장관들의 발언을 주목해야 한다. 압달라 살렘 엘-바드리 석유수출국기구(OPEC) 사무총장은 지난 22일 “해결책을 찾지 못한다면 직면한 공급 과잉 문제가 수년간 지속될 수 있다”며 대책을 찾기 위해 비OPEC 회원국과 협력하겠다고 말한 바 있다.

하지만 이 같은 발언은 유가 회복세를 위한 의도적인 행보가 아니냐는 의문이 제기됐었다. 또한 지난 1월 노박 석유장관은 사우디가 원유감산을 할 것이라고 말했지만 사실이 아닌 것으로 밝혀져 국제유가가 또 다시 하락했다.

이 때문에 현재 노박 석유장관이 말한 ‘산유국 감산동결 합의’에 대한 발언도 의문을 가질 필요가 있다는 것. 실제로 합의가 이루어지는지 아님 또 새빨간 거짓말인지 관망세를 취해야 한다고 전문가들은 조언하고 있다.